Whitepapers, Courses, and Presentations

Visualizing Survey Data Whitepaper

An updated version of Tableau’s whitepaper on visualizing survey data (written by Steve Wexler of Data Revleations)

Download Survey Data Whitepaper

On-demand course: Visualizing Survey Data Using Tableau

In this intensive hands-on course, participants will learn both best practices in survey data visualization and how to use Tableau to render these visualizations.

2014 Tableau Conference

Video recording of Steve’s Visualizing survey data presentation from the 2014 Tableau Conference. Note that there are now better ways to get the data “just so” but the overarching concept is still the approach you should use.

2014 Tableau Conference

PowerPoint, packaged workbooks, and source files from Steve’s presentation at the 2014 Tableau Conference.

2016 Tableau Conference

Visualizing survey data 2.0 — Recording of Steve’s presentation from the 2016 Tableau Conference.

Updates on getting data “just so”, Double pivoting, Different ways to show sentiment, Personalization, and what to do if filtering yields too few results.

2016 Tableau Conference

Presentation on visualization survey data 2.0. PowerPoint, packaged workbooks, and source files

2018 Tableau Conference

Steve’s presentation from the 2018 Tableau Conference: “What’s new with survey data? Lots!”

More on getting the data “just so”, More thoughts on showing sentiment, Showing uncertainty, Dealing with Really Big Surveys, cutting one question by the results of another (intra-question analysis).

2018 Tableau Conference

Presentation on “What’s new with survey data? Lots!” Download PowerPoint, packaged workbooks, and source data.

General Survey Considerations

WTF? Why doesn’t this survey data stuff work?

Read this first.

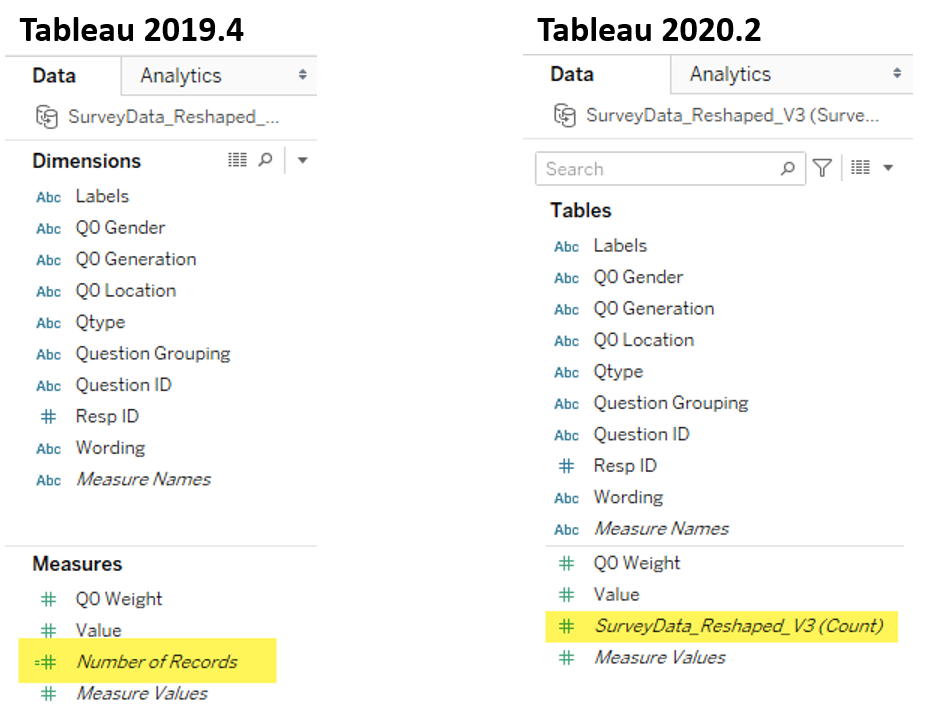

Getting Survey Data “Just So”

A review of how and why survey data should be formatted a certain way

Getting Survey Data “Just So” using Tableau Prep

How to use Tableau Prep to get survey data in an optimal format

Getting Survey Data “Just So” using Tableau 10.x

How to use Tableau 10.x’s pivot feature and ability to join different data sources to get survey data in an optimal format

Getting Survey Data “Just So” Using EasyMorph

How to use EasyMorph to get survey data in an optimal format

Getting Survey Data “Just So” Using Alteryx

How to use Alteryx to get survey data in an optimal format

Using Qualtrics’ Web Data Connector

How to use Qualtrics’ web data connector with Tableau

The Second Thing You Should Do When Working with Survey Data

Once you get the data “just so” you should do this.

Using Google Forms for Survey Data with Tableau

How to deal with the unfriendly way that Google Forms encodes check-all-that-apply questions.

How to Visualize Check-All-That-Apply Questions in Tableau

How to fashion a simple calculation that will work with regular and weighted data.

Dealing with Survey Tools that Don’t Code Check-all-that-apply Questions Correctly

How to deal with survey tools that code 1s and blanks instead of 1s and 0s. SurveyMonkey users, this is for you.

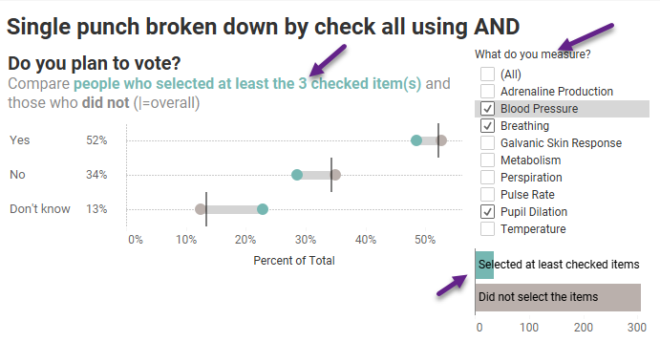

Breaking down the results of a question by a check-all-that-apply question

How to use Tableau’s Relationship feature to cut / filter questions by check-all-that-apply questions.

Intra-question analysis –Cut and filter any question by any other question (Part 1)

Cut and filter any question by any other question.

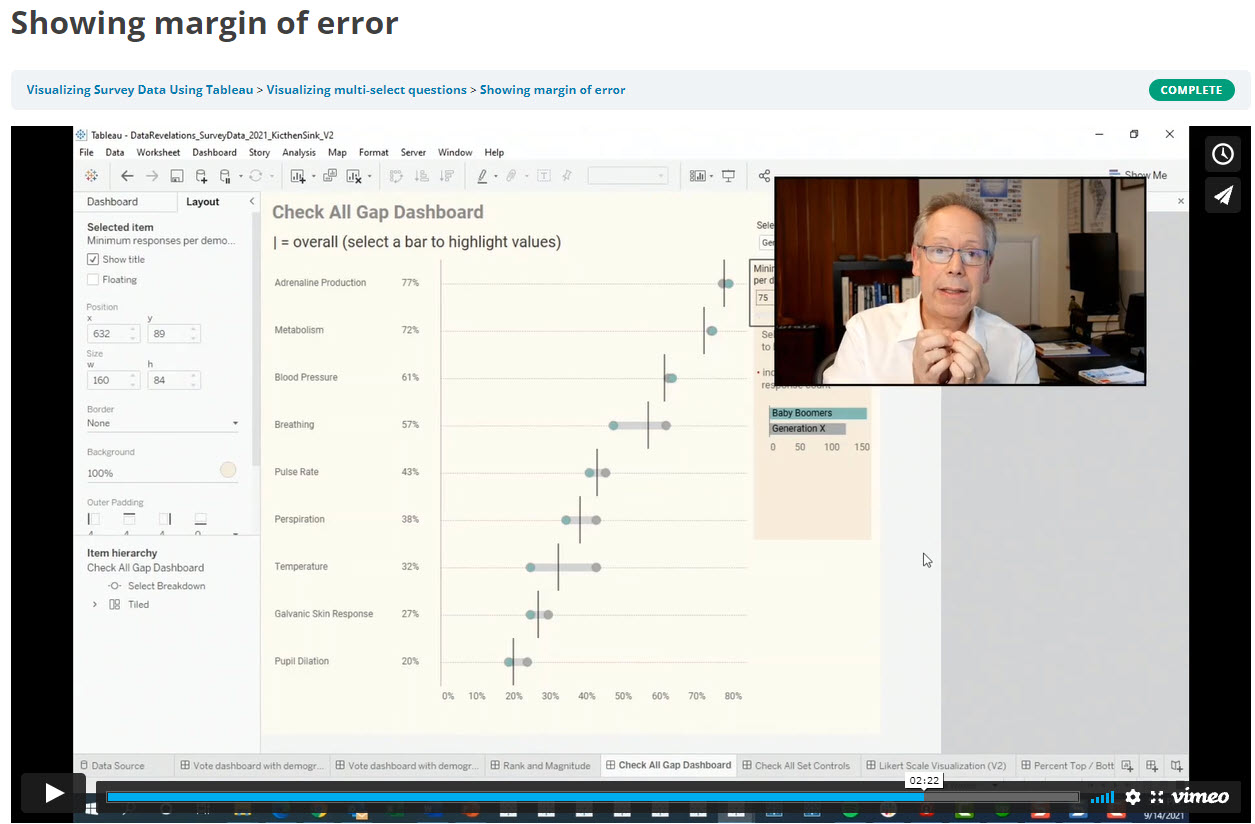

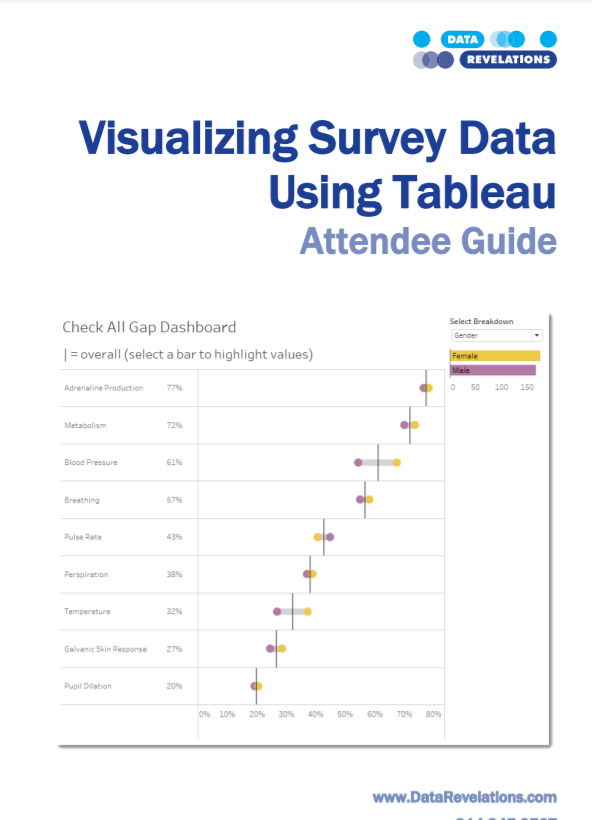

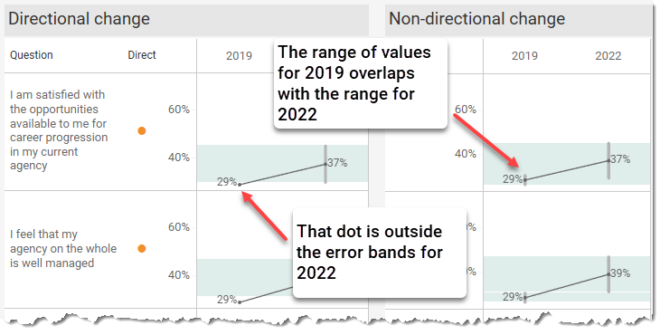

Showing uncertainty in Survey Results

There’s always a margin of error in survey results. Here’s how you can show those error bars in Tableau.

More thoughts on displaying Margin of Error in survey data with Tableau

Some more thoughts and approaches to showing Margin or Error.

When Filtering Produces Too Few Responses

What to do when extreme filtering reduces the number of responses so much that the results are statistically

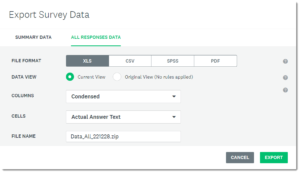

Getting SurveyMonkey data to play nicely with Tableau

This posts addresses the idiosyncrasies of downloading SurveyMonkey data and getting it “just so” so that it will work well with Tableau.

Visualizing Uncertainty in Longitudinal Survey Data

Help your stakeholders see just what plus-or-minus X points looks like with respect to Likert responses over time.

How Many People Selected 1, 2, 3 … N Items?

And what did they choose? Very useful technique for finding some surprises in check-all-that-apply questions.

Working with Weighted Survey Data

How to modify your formulas to deal with weighted responses.

Set Controls and survey data – how to compare responses for this group vs that group vs overall

How to compare filtered and unfiltered vs. overall results in the same visualization.

Showing Percentages? Lookout for these pitfalls

Two very useful techniques to combat Tableau’s auto-sizing axes.

Statistical Significance

How to show that changes from a previous period are statistically significant.

Comparing a target group with the entire population

How to compare filtered and unfiltered results in the same visualization.

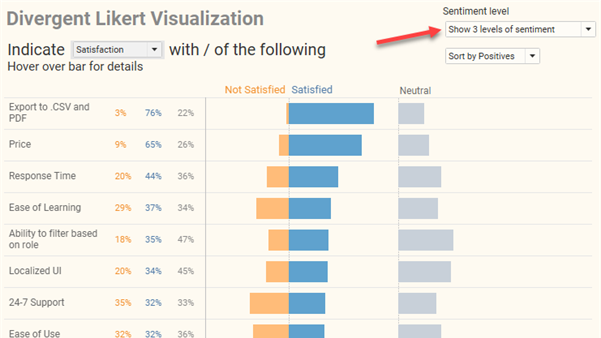

Likert Scale and Divergent Stacked Bar Visualizations

How to visualizing Likert scale data in Tableau

Why I think people should visualizing Likert scale data this way.

Visualizing Importance vs. Satisfaction

Both use Likert scales and both have to be shown at the same time to be able to make comparisons. Here are several approaches.

Rethinking the divergent stacked bar chart

There’s a good case for place the stronger views in the center.

Got Likert data? Put the Neutrals on the side

More thoughts on how to visualize this type of data.

Guns, Gantt Bars, and Divergent Stacked Bar Charts

Another good case for divergent stacked bars

Likert vs. Likert on a Scatterplot

Finally, a good use for packed bubbles to show how responses to one question compare with responses to another question.

Visualizing Net Promoter Score data

Using a divergent stacked bar chart with NPS overlap to make the data clearer

Visualizing Sentiment and Inclination

Dealing with different sentiment scales (NPS, Likert, Top 3 minus Bottom 3, etc.) and showing sentiment and inclination over time.

Don’t Ignore the Neutrals!

Dealing with polarized survey responses and the importance of highlighting neutrals (or lack thereof.)

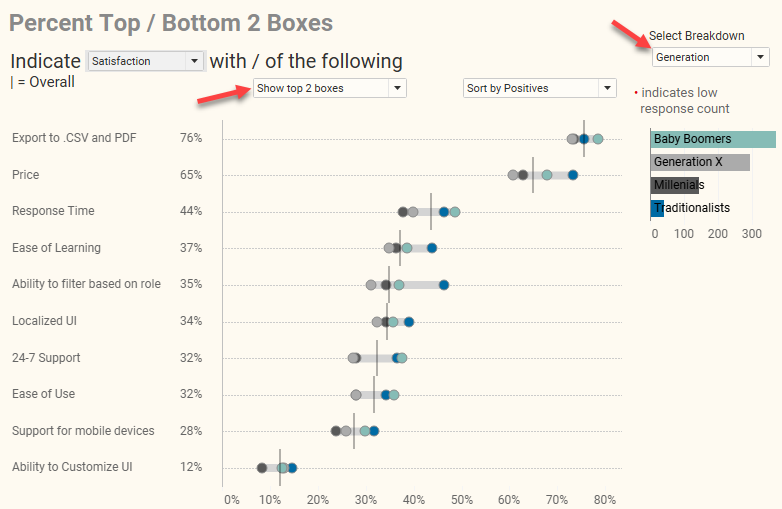

How to visualize Likert scale data broken down by different demographics

The gap chart (aka, “barbell chart” or “connected dot plot”) is my choice for this.

Likert Scale Questions the Zvinca Way

An alternative, and I think better, approach to presenting Likert scale data

Benchmarking and Visual Ranking

I’ve Got the Jitters (and I Like it!)

Using a jittering technique with benchmarking data

Boxes, Whiskers, and Jitters

Making box-plots easier to understand

Seeing thing with fresh eyes

Why I still love the jitterplot

Is this better than a Jitterplot? Could be

Check out the unit histogram / Wilkinson dot plot.

Visual Ranking within a Category

Technique to show how responses rank when broken down by different dimensions. Great technique for showing rank and magnitude at the same time.

Makeovers

All Politicians Lie, Some More than Others

A recasting of a New York Times infographic

Mostly Monthly Makeover — Masie’s Mobile Pulse Survey

A look at some visualizations from the MASIE center and suggestions on how to improve them

Mostly Monthly Makeover – Utah State University Survey of Student Engagement

A look at survey results from Utah Stage University and suggestions on how to improve them